Michael Perschke, CEO Quantron AG

Anuj Monga (AM): You have just launched a potentially game changing proposition. Can you tell us a little more?

Michael Perschke (MP): As we are not an energy company, we have to strategically orchestrate the sourcing, transportation, and fueling of green hydrogen. We do not necessarily see that we need electrolysis as a CAPEX in our balance sheet. Instead, we need hydrogen suppliers who will enter into a long-term agreement to supply green hydrogen at competitive prices. For that, we now also have Neuman & Esser as an alliance partner because it is one of the leading companies that works at compressors. And compressors are crucial elements in a 700 bar technology truck.

The second key aspect is having partners like Ballard Power Systems, a leading fuel cell supplier, as well as cutting-edge hydrogen tank suppliers, and e-axle suppliers. This allows us to get a truck like the one we exhibited – a 44t fuel cell electric vehicle (FCEV) heavy duty truck – which has no limitations vis a vis a diesel truck. We do not plan on an extension of the length of the vehicle since this will entail corresponding changes on the regulatory front. We give a truck operator a vehicle that looks identical from the outside and can fulfil 90% of use cases of a diesel truck – payloads, length, and sleeper cabin. This represents the hardware side.

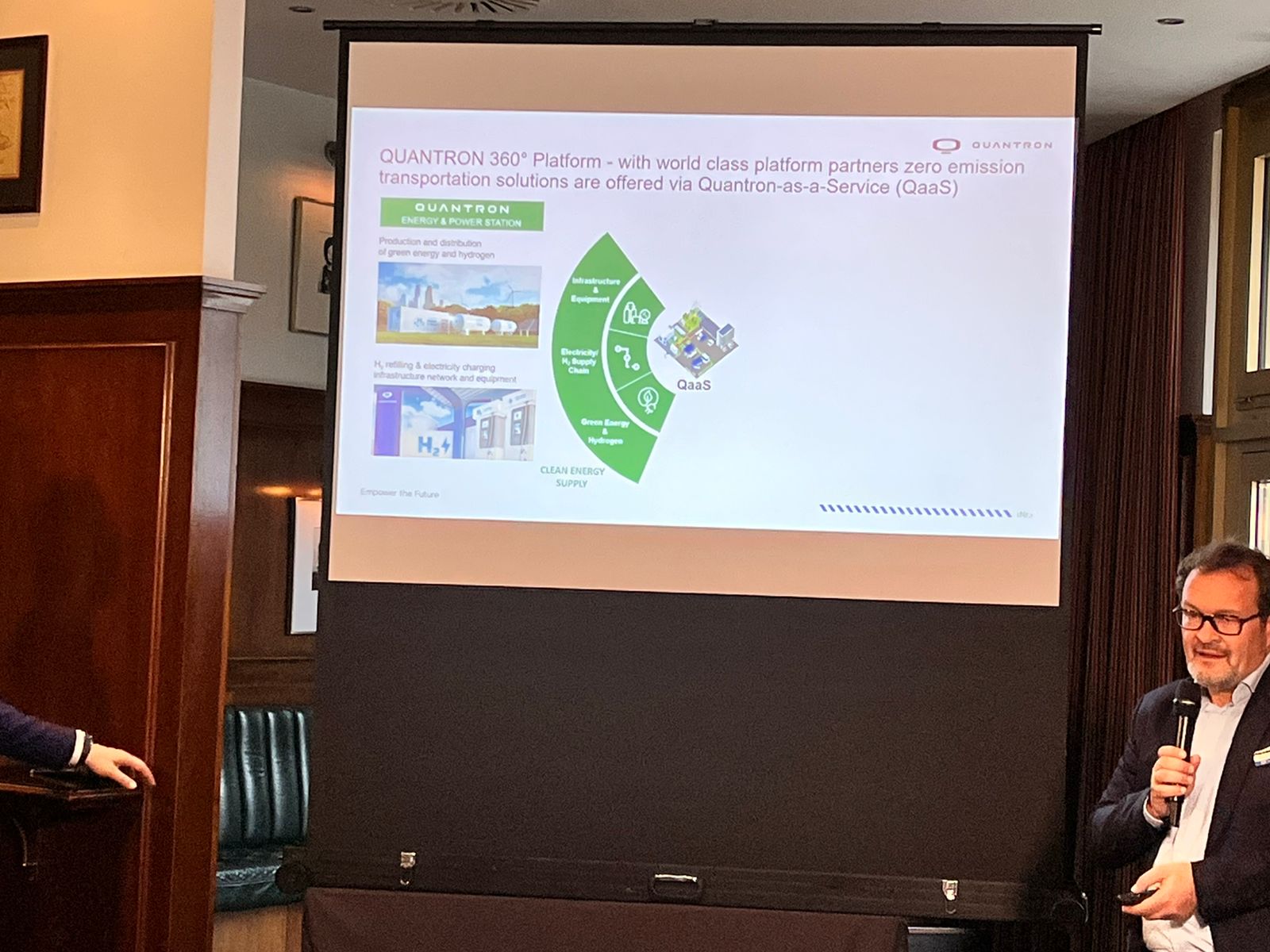

The last part is to put these vehicles into a running service. We are looking to run assets for about 6-8 years for our clients. We will look after service, maintenance, fleet, and the entire billing of the services. Quantron-as-a Service is a platform where, today, we predominantly operate Quantron trucks, but it is our and our partners’ ambition to have an open platform. This is because we believe that before we can really compete with each other, we first need to get a critical mass of acceptance for hydrogen, in general. We want to be one of the trailblazers, but we are happy to integrate and cooperate.

AM: How critical will the Open Alliance be as a long-term strategy for this platform?

MP: For us, having an alliance to establish a hydrogen ecosystem is key. An alliance springs from collaborative thinking and the strength of the whole alliance depends on the strength of its individual partners. That is why we see this alliance as one of our most important strategic assets. Furthermore, having an alliance partner as an investor reflects an extra commitment. In this context, Neueman & Esser and Ballard go beyond just being alliance partners; their investment reflects a level of financial commitment.

AM: While hydrogen is a great solution, the question is what will tip the balance, help achieve parity between traditional diesel trucks and hydrogen trucks, and push customer transition from traditional diesel vehicles to fuel cells?

MP: The cost of hydrogen in the medium to long term must come down. There have been several news reports of companies claiming to produce green hydrogen at €1-1.50 or €2-2.50. This is just the production aspect; one still needs to look at CAPEX of the infrastructure. So it all depends on energy; because one needs 50 kW of energy to produce 1 kg of hydrogen. If efficiency improves, it could reduce to 30 kW per kg of hydrogen. Ultimately, however, the cost of green energy is the key. This is where countries like Iceland and Norway have been so successful, as they have hydro-energy and, hence, we believe the other piece of this puzzle is the energy that is not being harvested. Mr. Hubert Aiwanger, Deputy Minister, President of Bavaria and the Bavarian Minister of Economic Affairs, confirmed that in Bavaria alone there is unused and unharvested deregulated energy from its sources up to the amount of one nuclear power plant. Accordingly, energy, managing the ecosystem, and getting economies of scale on the hardware are the most critical points for us. Once this happens, then costs will come down.

Eventually, it is all about unit costs. We are selling green mobility on a km pricing. That is how we visualize it long term. Then it does not matter whose hardware we have as long as we can manage the platform.

AM: Currently your focus is Europe in terms of operations and immediate customers. Which other markets are you looking at?

MP: Europe is our home market, but we are keenly looking at the US. Our ambition is to have a demonstrator at the ACT Expo where, similar to the European truck, we have something to show that runs by itself, has first class components, and can fulfil duty cycles that are standard in the market. In the US, we do not talk about 44t, we talk up to 66t and about trucks running 55-65 miles continuously. There are fewer traffic jams at agglomerations like Los Angeles. Further Midwest and then even further north towards Canada, there are topographic and climate challenges for battery electric trucks, with battery electric trucks reaching their limitations, as well as limitations while doing longer distances. It is a standard to do 300-400 miles on one go. So 66t at 65 miles/hour for 400 miles is impossible today for a battery electric truck to resolve.

For us, the sheer size of the US truck market makes it an attractive target. The US has roughly four million Class 8 trucks on the road and 300-400,000 trucks can be sold in good times.

AM: For all this technology running in a truck on the road for all these miles, do you also see aftersales as a critical function for your company?

MP: Absolutely. The good thing is that a hydrogen electric truck is both hydrogen and electric. It has lower maintenance needs than a traditional ICE truck. There aren’t any lubricants nor so many moving parts. But still certain things can break down. In the future, there might be more “virtual’ breakdowns on the software side as software becomes more prominent. So the traditional aftersales store will become less dense but then there will need to be 24/7permanent surveillance of the truck. Therefore, one will need to enhance digital services, telemetric services, and cloud services. In the US, we will look at both sides: we will have new trucks, but we will also look at retrofit solutions.

AM: There are big question marks over aftersales in the electric vehicle market. Challenges are bound to crop up on this side as well.

MP: Today, there are taxis running in Los Angeles for 600-700,000 miles, sometimes even on the first set of batteries. So the breakdowns of lubricants, of repair or maintenance requirements for a service organization might not even be one-third of what they have known for an ICE.

René Wollmann, CTO of Quantron AG explaining Fuel Cell Electric Vehicle (FCEV) Heavy Duty Truck

AM: Do you see hydrogen technology moving towards medium or lighter duty vehicles?

René Wollmann (RW): At IAA we are also unveiling our light duty FCEV which covers a range of up to 500 kms, with a tank of around 8.2 kg, and is completely chassis integrated. Our principal idea is that our vehicles, rather than being niche, should be oriented toward client needs. For some applications, therefore, battery electric vehicles (BEVs) are fine. In others, where more energy content is required, one could look at fuel cells. At some point if we are talking of 800 kWh, then the battery becomes really heavy. So we will have to talk about payload reduction. Even the chassis has to withstand the heavy batteries. What we really need is to combine and use the two worlds of fuel cell and battery electric in optimal ways.

MP: Based on our simulation, in the quadrant of last mile which is around 100-200 miles for 7.5t truck, we see BEVs as still being the best solution.

RW: With this 44t truck, we can do special applications that require front steering axle, 3.6m wheelbase, and where you can couple a trailer with as many axles as are needed, but this tractor is designed to accommodate fuels, tanks, and e-axles, etc. With this truck you can address around 60-70% of market demands. It is the very special applications with unique requirements that we would not be able to target.

In Europe, say on autobahns where these trucks have to travel 200, 300, 400 kms at high speeds, BEVs become a challenge. We pitched with a few clients for a 7.2t FCEV, which we will unveil in IAA, and received a bigger reception for it than we expected. We cover the full circle with battery electric and hydrogen solutions from small vehicles up to heavy duty and buses. This allows every client to find the right solution for their needs.

AM: How do you see the infrastructure around hydrogen developing?

MP: Our business model is currently not counting on the availability of pipeline infrastructure. There will be pipelines coming up, especially in Holland and other areas where liquified natural gas (LNG) pipelines are becoming vacant because gas is not a business anymore. If cleaned up, they could theoretically be suitable for hydrogen. However, this will require massive electrolyzing capacities. Except for Shell, I cannot see anyone building this size of capacity for producing green hydrogen.

We believe in central production in certain locations, like Norway, whether for liquefied or compressed hydrogen. I think for long distance transport, liquefied will have benefits but then it will also have higher CAPEX. For specific regions, regional or decentralized production makes a lot of sense, especially if there is a surplus of green energy. There will also be certain clusters where waste-to-hydrogen will present opportunities. In short, there is no one-size fits all.

With inputs from Jagadesh Chandran and Saideep Sudhakar.