8 Insights into What Motivates Your Customers and Ways to Delight Them

In a recent report, 2022 Retail Trendwatch by Vericast, 77% of retailers say they need to give consumers stronger reasons to purchase.

Ideally, those reasons should correspond to actual consumer motivations.

But at a time when inflation is nipping at the heels of post-pandemic-wary shoppers, and shipping delays and labor shortages are plaguing store operations, retailers are facing a swirl of seemingly contradictory consumer expectations.

On one hand, customers appreciate the convenience of self-service and the instant gratification that automated processes provide. At the same time, they relish personal interactions with store associates that add value to their shopping experience.

69% of consumers globally who admit to behaving inconsistently think that paradoxical behaviors are both human and acceptable. [The Human Paradox, Accenture, 2022]

Mixed messages? Maybe. The bottom line? Consumers want it all. That’s according to a Research Insights report by IBM in association with the National Retail Federation.

Winning the hearts and minds of retail customers is a balancing act. The key drivers that compel shoppers to visit stores, buy certain products, stay loyal to brands, and make repeat purchases all function in tandem. And as Accenture reports in a 2022 study, The Human Paradox, “Consumers are showing they are comfortable being multi-dimensional, but many businesses continue to see them in just one way: as walking wallets.”

88% of executives think their customers are changing faster than their business can keep up.

Now more than ever, retailers should make a concerted effort to keep pace with consumers’ changing motivations and understand how they coalesce and drive customers to shop and buy. With this understanding, retailers can strike the right balance between fair pricing, excellent product quality, and unparalleled service. In the best scenario, this will spark innovations that assure brands and stores remain indispensable in the future.

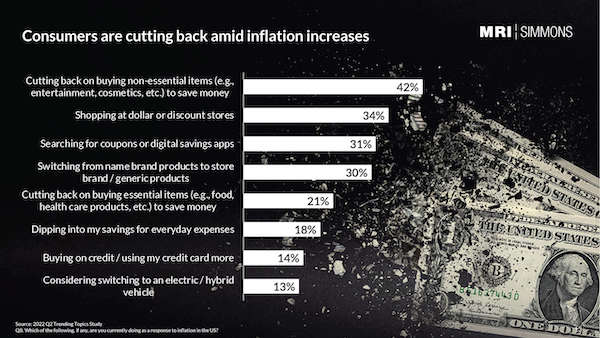

81% of retailers say consumers are looking for more deals and discounts.

Uncertainty about the economy and rising inflation have consumers cutting back on non-essential spending and turning their attention to special promotions, rewards, and bargains. Merely lowering prices isn’t enough, however. Research shows that consumers are more likely to respond to personalized offers that promote enhanced services and rewards for loyalty. In addition, consumers will readily glom onto perks such as a fast return process, a liberal exchange policy, a price-matching promise, and special in-store sale days.

63% of shoppers say they visit stores more often when they are a part of that store’s loyalty or credit-card-based rewards program. [The New World of Consumer Behavior: Retail 2022-2023, NEAR, November 2022]

Near’s report, The New World of Consumer Behavior: Retail 2022-2023, emphasizes how loyalty programs allow retailers to track shoppers’ product and purchase preferences. This opens the door to recommending products and making special offers that drive shoppers back to the store. Subscribing to or becoming a loyalty program member should be a seamless part of the customer experience.

46% of shoppers plan to purchase products or services to make their home more enjoyable, comfortable and beautiful, and 55% are willing to try a new retailer to satisfy the purchase.

Despite inflation worries—and perhaps an attempt to escape from it—consumers are seeking to treat themselves to something special and fun. Stores can highlight the “fun factor” of certain brands and engage shoppers in imaginative ways. Consider a cookware demonstration, a celebrity appearance, or an educational seminar that ties in with a brand’s identity or sustainability policies.

54% of shoppers prefer stores that have apps. [The New World of Consumer Behavior: Retail 2022-2023, NEAR, November 2022]

Embracing digital technology is a must for brick-and-mortar stores. Tech-savvy customers expect to use digital tools throughout a hybrid buying journey that carries them seamlessly from online interactions to in-store engagement. According to the 2022 MR-Simmons Retail Trends Study, 80% of shoppers aged 18+ find it appealing to use self-checkout kiosks and make contactless payments. And usage—meaning, an off-site professional who provides remote support for in-store shoppers—nearly doubled from 18% in 2021 to 32% in 2022.

However, technology can be a double-edged sword. According to Accenture, up to 43% of consumers say technology advancements have complicated their lives just as much as they have simplified things. Proceed cautiously; automating for automation’s sake, without considering its usefulness and purpose for consumers, can lead to a shopper disconnect.

84% of consumer shop in store because they appreciate quick returns.

81% of consumers shop in store because they want to get products they want quickly.

Clearly, automation isn’t limited to labor-saving devices for retailers or a mere convenience for shoppers; it satisfies a need for faster and more responsive service. Automated chatbots, virtual assistants, standalone self-service kiosks, and smartphone-based instant checkouts are just a few popular examples.

93% of consumers say it’s important that the products they want are available in stores.

47% of consumers have switched stores or purchased something different due to product shortages.

32% of retailers think a big challenge will be people switching products because their preferred product isn’t available.

Since snapping your fingers to make products appear on store shelves magically isn’t a viable option, retailers can step up their game by emphasizing exceptional service that shows personal concern for consumers’ wants and needs. Don’t make excuses for out-of-stocks. Be real. Apologize and earn shoppers’ trust and loyalty by giving them a compelling reason to come back.

Consider promoting the high quality and the unique aspects of your brand beyond price – for instance, your company’s values. Consumers will flock lockstep into your loyalty programs when they discover you support causes, organizations, or efforts that resonate with what they personally value in life. In fact, 66% of shoppers rank sustainable practices and selling sustainable products as the highest of all factors when choosing which stores to visit. [Charting In-Store Trends, Mood Media, October 2022]

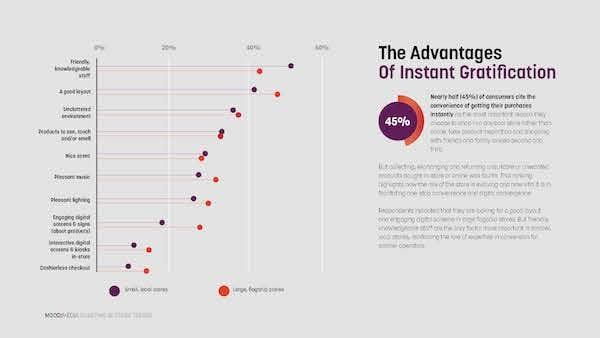

84% of shoppers would return to a store with a pleasant atmosphere, with 51% citing the availability of friendly and knowledgeable store staff as the most important factor.

Elevating the customer experience can differentiate stores and brands and mitigate circumstances that are beyond retailers’ control. Train associates in ways they can take ownership of their roles and become advocates for your products. Update store layouts to be more inviting and engaging. Install digital screens that welcome shoppers when they arrive and make self-serve kiosks an engaging component of their visit.

Important Reasons to Shop In a Store

Shopping preferences will continue to ebb and flow as cultural trends come and go, consumer priorities shift, and technology takes off in new directions. Through it all, retailers should regard every potential touchpoint as an opportunity to strengthen their bonds with shoppers, adapt to changing shopper values, and make their experience more delightful and memorable.

Ready to talk?