The EICMA Fair, one of the world’s largest international two-wheeler trade events, was back in top gear. The 78th edition of the annual show – fittingly billed “the Adrenalin is back” – was held between November 23-28 in Milan, marked by the presence of heavyweights like Yamaha, Kawasaki, and Honda. While the high concept bikes and glitzy accessories (and an appearance by recently retired MotoGP legend Valentino Rossi) were a massive hit with the audience, my interest was piqued by the big picture themes emerging from the show. The stand-outs were the electric two-wheelers that zipped up to front and center, setting the stage for new dynamics and innovative business models in the two-wheeler market.

Recommended Reading:

Global Two-wheeler Outlook, 2021

Global Electric Two-wheeler OEM Strategies and Growth Opportunities

Sifting through the buzz at EICMA, here are Frost & Sullivan’s five key takeaways:

- After the COVID lockdowns and despite chips shortages, the two-wheel market has rebounded strongly in Europe in 2021, with year-to-date (YTD) sales in September up 10.8% compared to the same period in 2020, reaching 792,8000 units and constituting an 8.2% increase compared to the pre-pandemic period in 2019. Signaling that positive trends will continue, orders for motorcycles below 125cc are expected to be 10-15% more in 2022 than in 2021. Two-wheelers are considered a safe and more accessible urban transport solution compared to crowded public transport modes. They are also perceived as a strategic business model solution for shared and sustainable mobility. In September YTD, Italy led two-wheeler growth in Europe with a growth rate of 27.9% driven by the government’s effective incentives schemes. The UK followed it at 13.5%, Spain (8.7%) and France (8.5%). On the flip side is the estimated 5% decline in two-wheeler market growth in Germany.

- Asian OEMs are moving aggressively into Europe via distributor and importer agreements and M&A operations as they set out to expand their manufacturing footprint in the region and leverage local brand awareness. This will mean increased competition in the entry-level segments, accelerated technology adoption, and an added push towards electrification and shared mobility.

- Electrification and connectivity are significant trends, with the scooter segment already offering a comprehensive product range. Here again, Asian OEMs represent emerging players of the product and technology offering. Established European scooter OEMs are taking two distinct routes to push the electrification agenda: one, they are leveraging their existing brands via product range extension operations and, two, they are simply launching new dedicated product divisions / new brands. According to Frost & Sullivan’s analysis of the global two-wheeler market, the electric two-wheeler market in Europe is expected to register a CAGR of above 10% between 2021 and 2025.

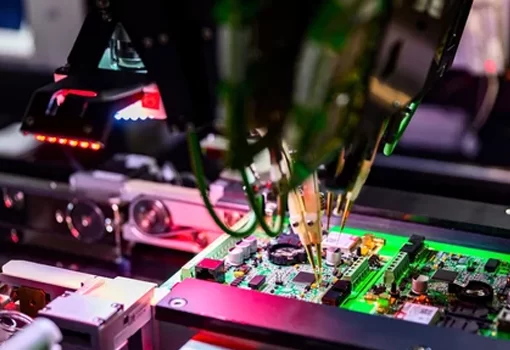

- Tier-1 suppliers will have an increasingly strategic role in shaping the emerging electric two-wheeler market. Tier-1 suppliers have operations in four and two-wheeler markets and will play a key role in transferring best practices that have already been implemented in the more technologically advanced electric vehicle business to the developing two-wheeler segment.

- An increase in raw material and manufacturing costs aggravated by logistics and procurements will impact listing pricing in 2022. All major OEMs are planning to increase their listing prices from 2022, incorporating cost increases to maintain profitability levels. This may impact market demand partially, even if the initial feedback from dealership networks in Europe is likely to be that customers accept such increases. The critical challenge will be to manage the dependence on imported lithium batteries, mainly from China.

In short, 2022 promises to bring more action and energy as the two-wheeler market begins to deepen its engagement with electrified roadmaps.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: http://frost.ly/60o.