Despite whispers about economic uncertainty, consumers show few signs of slowing spending. In 2023, 41% of consumers said they intended to splurge. Many shoppers followed through, checking items off their wish lists throughout the year’s first half.

However, consumers leaned into strategic spending this year, while consistently hunting down the best deal.

It so happens that partnerships motivate today’s savvy consumers to purchase.

The 2023 Mid-Year Consumer Trend research study by impact.com analyzes consumer spending during Q1 and Q2 of this year, comparing it to the same time periods 2022. These insights offer brands the data they need to craft a winning partnership strategy that aligns with evolving consumer preferences.

Key takeaways

- Consumers were more intentional about their purchases: while total clicks decreased by 39% from 2022, the conversion rate increased by 54%.

- Publishers saw a 6% increase in commission earnings.

- More people shopped for apparel, shoes, accessories; home and garden; and sports, outdoor, and fitness products than in 2022’s first half.

Methodology

impact.com’s Data Science team conducted the study. The research tracked and analyzed key metrics across hundreds of North American brands in the retail and shopping vertical to compare the first half of 2023 to the first half of 2022 in a year-over-year (YoY) analysis.

Our analysis benchmarked partnership performance metrics like:

- Clicks

- Transactions

- Conversion rate

- Average order value (AOV)

- Commission

- Revenue

Researchers tracked these KPIs by comparing same-store, YoY data from brands that actively used the impact.com platform in 2022 and 2023.

This report aims to offer retailers deeper insight into:

- How consumers engaged in online shopping during the first half of 2023

- How the economy impacted consumer spending choices in 2023 compared to 2022

- How brands can appeal to consumers in the second half of 2023

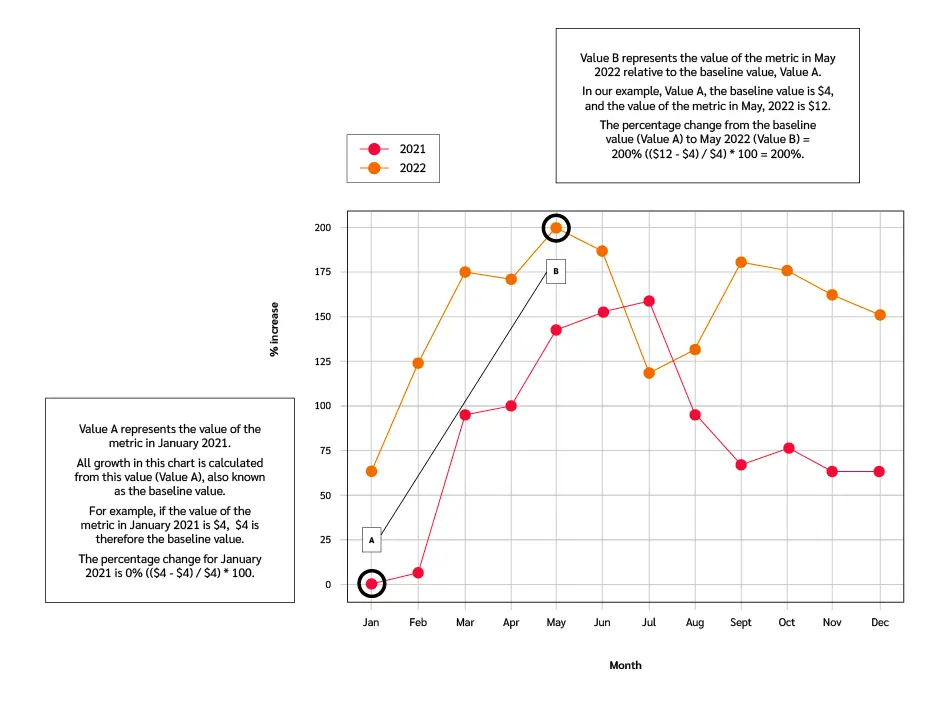

Interpreting the graphs

The values shown in each graph represent the percentage change in a metric’s value relative to that value at a specific time, also called the baseline value.

Our analysis measured all values as a percentage change relative to the baseline value from January 2022.

For example:

6 key insights that shape consumer spending in 2023

1. An up-tick in intentional buying

Conversions reveal a compelling story about this year’s shoppers.

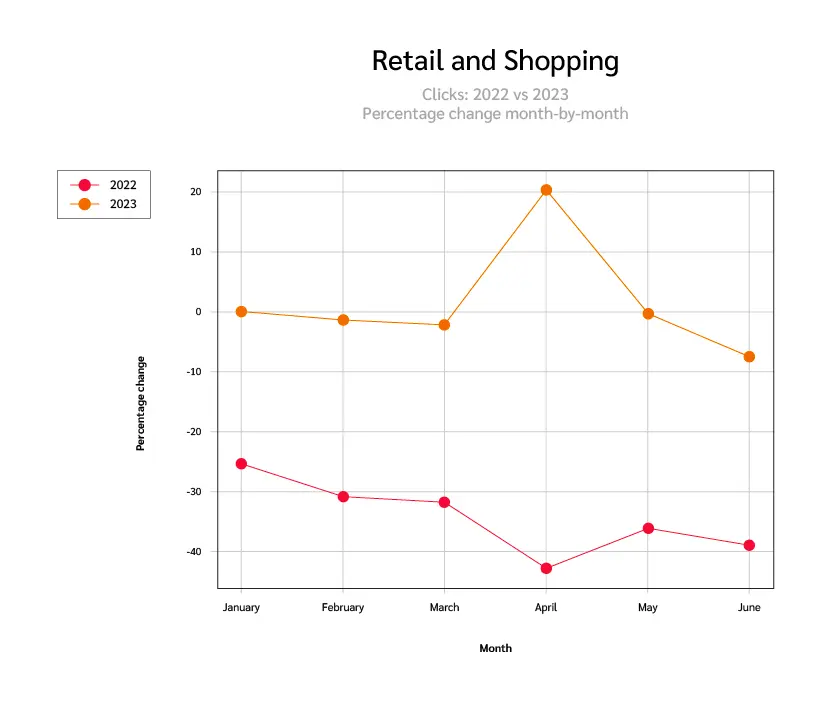

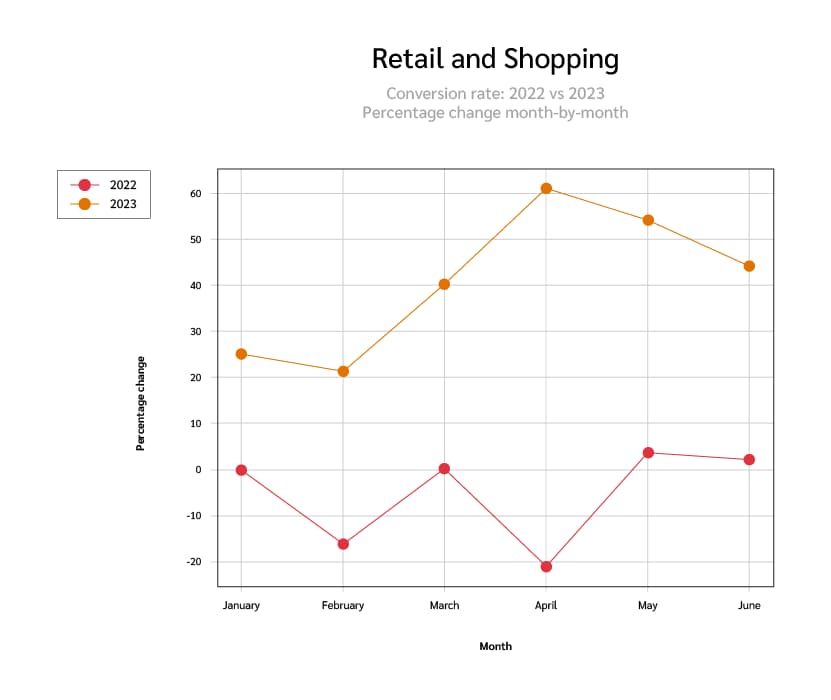

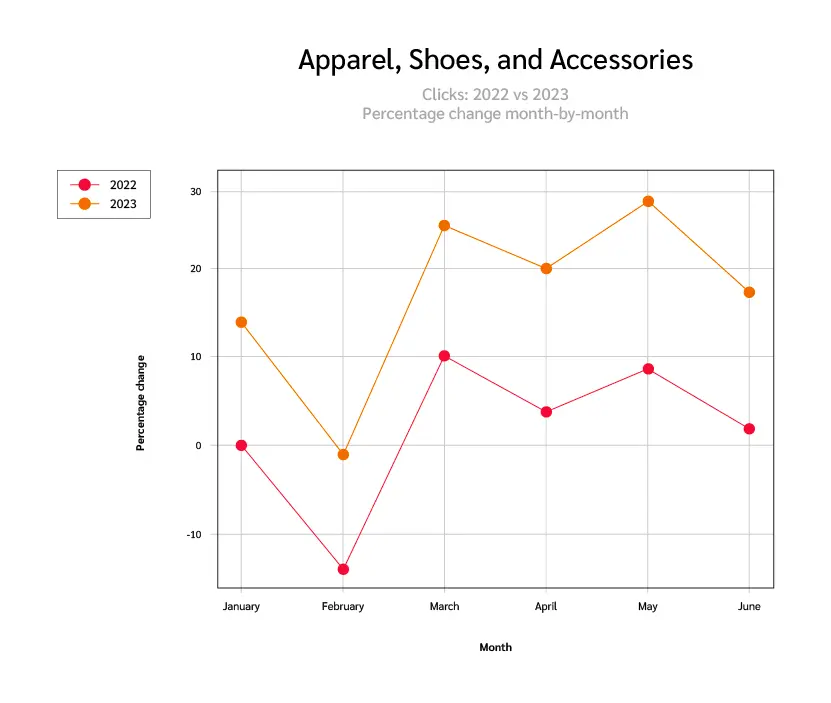

Despite a significant 39% decrease in clicks during Q1 and Q2 of 2023, conversions were 54% higher than the previous year.

Consumers aren’t splurging on impulse purchases this year. Instead, they’re pre-planning purchases for popular shopping days so they can take advantage of discounts and promotions.

Thoughtful partnerships may be the key to guiding intentional shoppers to splurge. Partners can highlight a product’s value and help the brand earn a coveted spot on shoppers’ wish lists. Once a product makes it on the wish list, today’s conscious shoppers wait for the right time to buy.

2. Discounts sealed the deal

Today, 90% of consumers want a discount, coupon, or cash-back reward. Discounts motivate strategic spenders to “add to cart,” especially during sales or popular promotion days such as holidays.

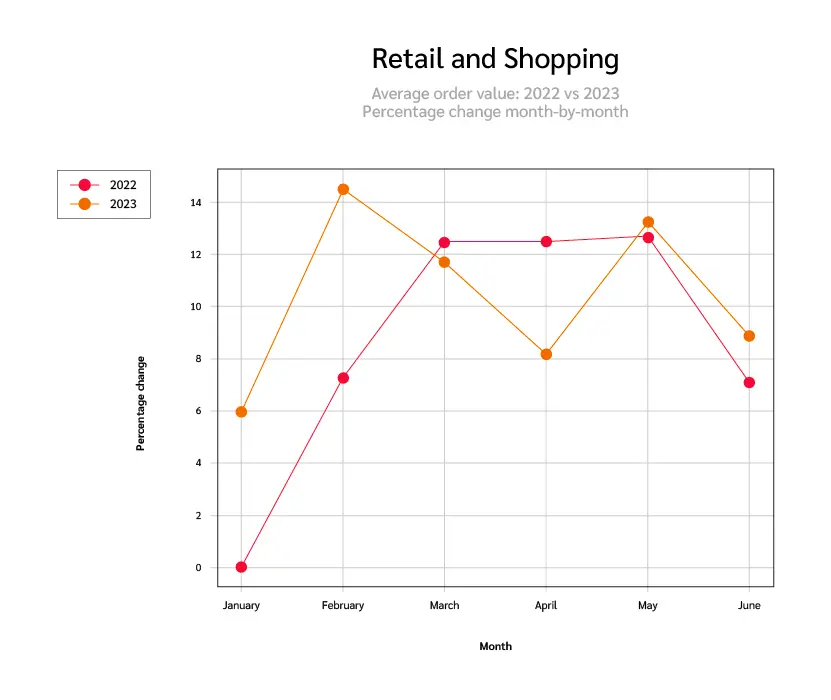

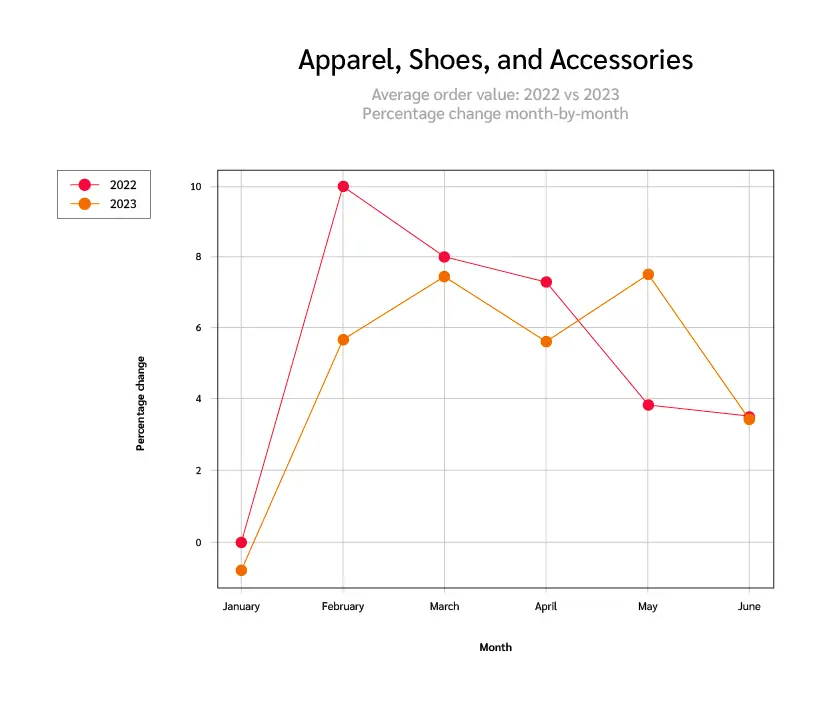

Relatively steady AOV YoY reveals another interesting trend. Even with 7% fewer transactions YoY, a higher AOV over most months in 2023 shows a greater per-transaction spend than last year.

April showed a substantial AOV drop, which may signify that shoppers were waiting for popular shopping days, such as Mother’s Day and Memorial Day, to secure better deals.

Brands gain an edge and motivate purchases when offering deals through partners. Giving partners a dedicated coupon code when they promote your products may push shoppers to buy before the holiday season.

3. Publishers earned higher commissions from brands

Many brands turned to partnerships as a way to adjust their marketing budgets during a period of high layoffs and budget cuts.

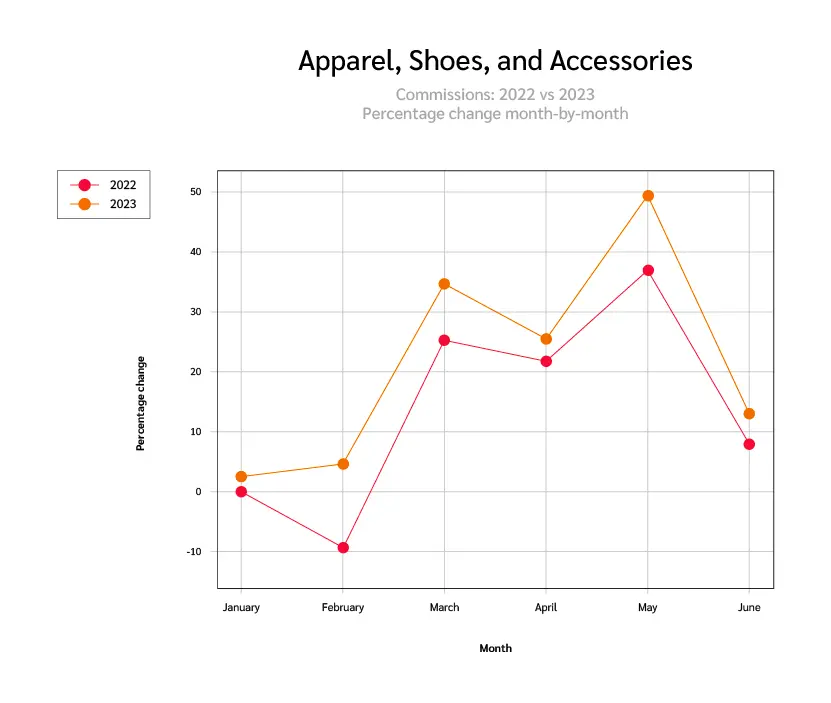

Despite more discerning consumers, publishers continued delivering results and were rewarded for their efforts. Publisher commissions increased 6% YoY.

As publishers take on heavier lifting to drive brand conversions, many request higher commission rates. With over 4 in 5 publishers measuring the success of their commerce content programs in commissions, brands offering higher commissions can tap into a significant motivator while fostering a reciprocal relationship.

4. Apparel, shoes, and accessories inspire discretionary spending

Shopping trends in the apparel, shoes and accessories product category were similar to what we saw during the first half of last year.

While sales dwindled at the beginning of the year, spending in this category rebounded in May with a nearly 4% increase in AOV compared to the previous year. Ultimately, AOV remained the same YoY.

Shoppers may have spent less on each purchase in 2023 than in 2022, but that didn’t keep them from browsing. Clicks increased by 14% compared to the same period last year, indicating that consumers may have compared prices more than before. However, transactions remained largely the same as last year.

A 6% increase in commission earnings indicates that brands paid partners more for driving clicks and greater sales this year.

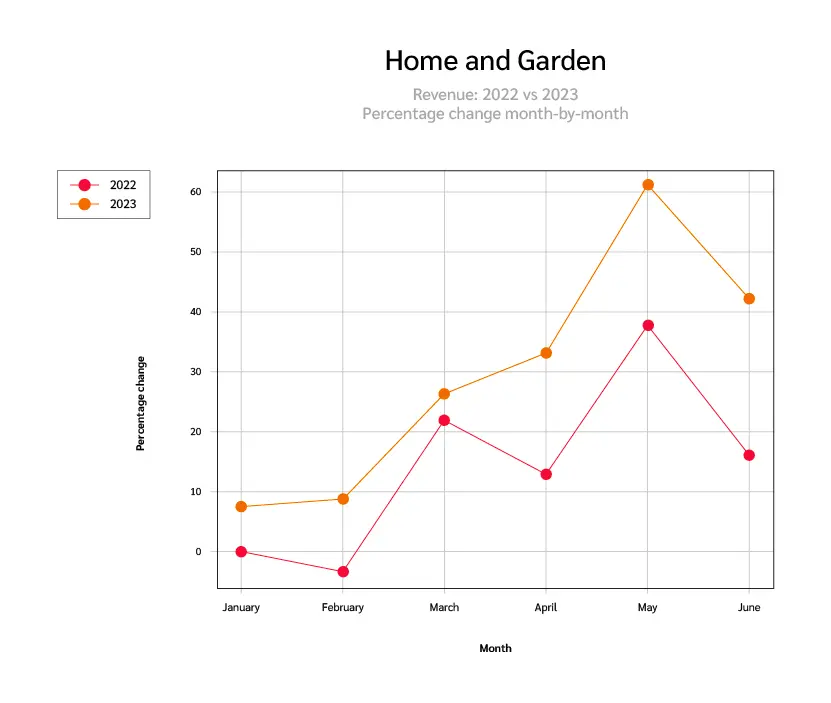

5. Home and garden experienced market expansion

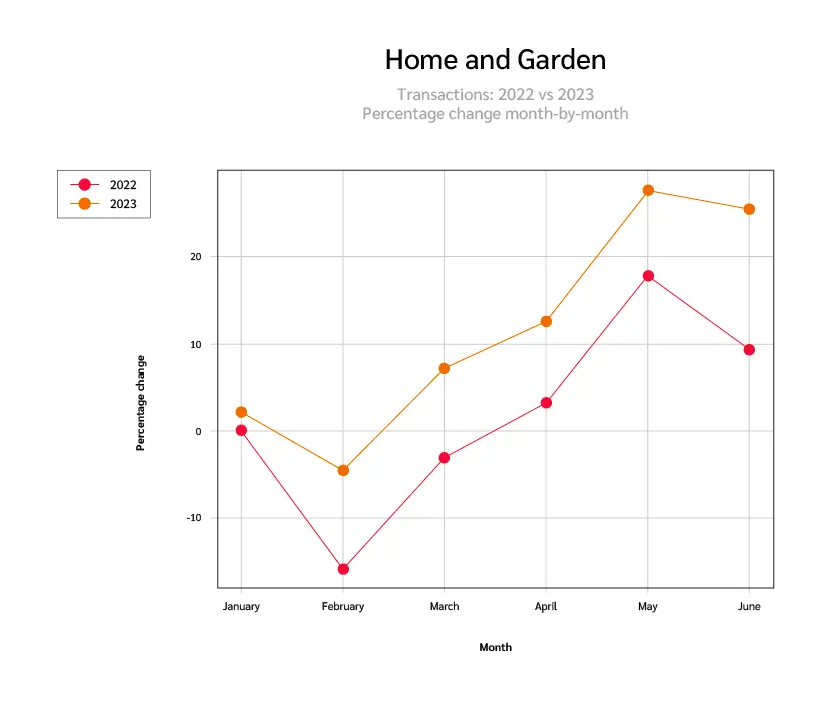

While only 21% of shoppers planned to splurge on home goods this year, consumers completed 10% more home and garden transactions in the first half of 2023 than in 2022. In fact, industry studies show that the consumer market saw 10% growth YoY.

Partnerships and other marketing efforts helped brands reach more people and capture more consumer interest in 2023. As their pool of potential customers increased, so did sales. Consumer spending per order increased by 3%. This, in combination with the increase in transactions, resulted in a 14% boost in brand revenue compared to the previous year.

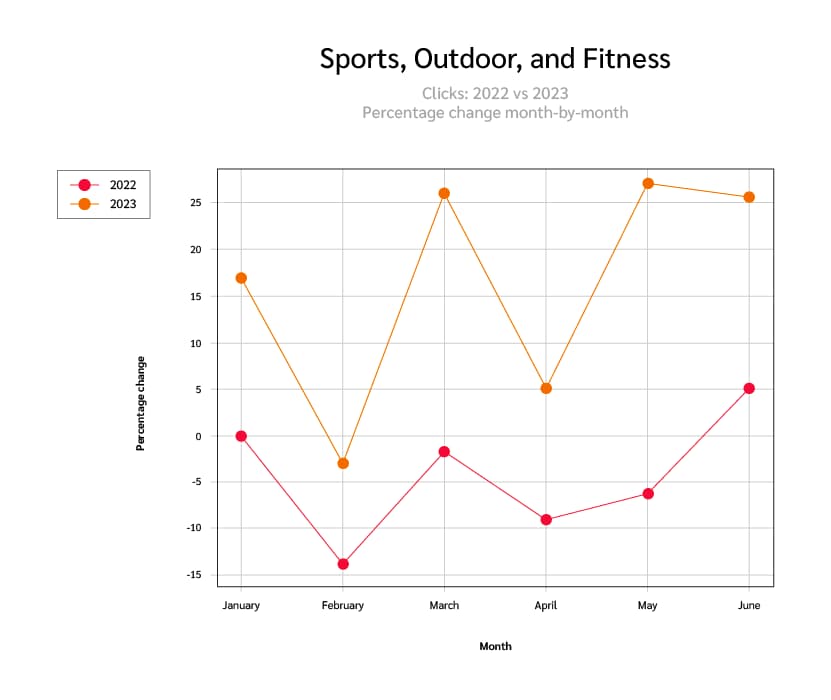

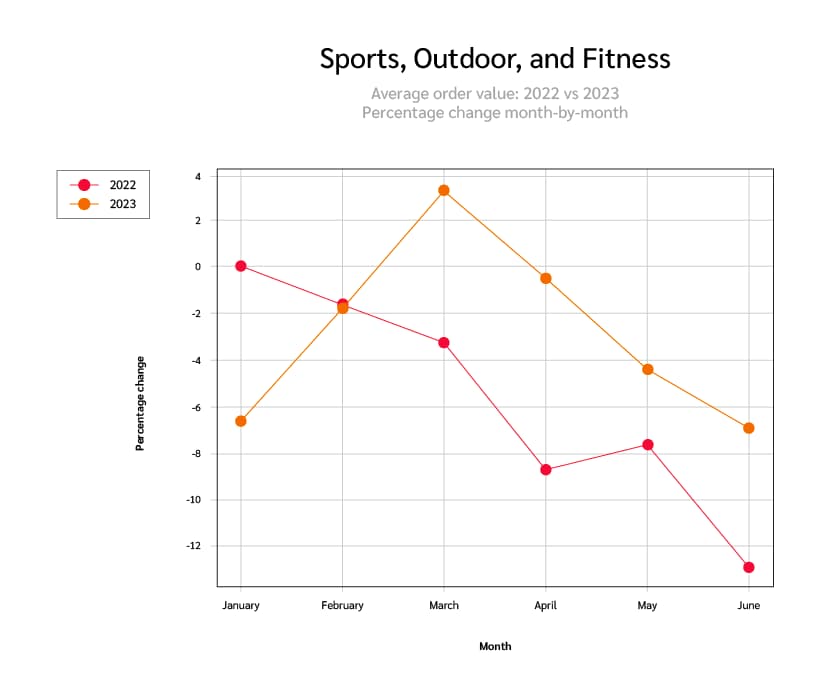

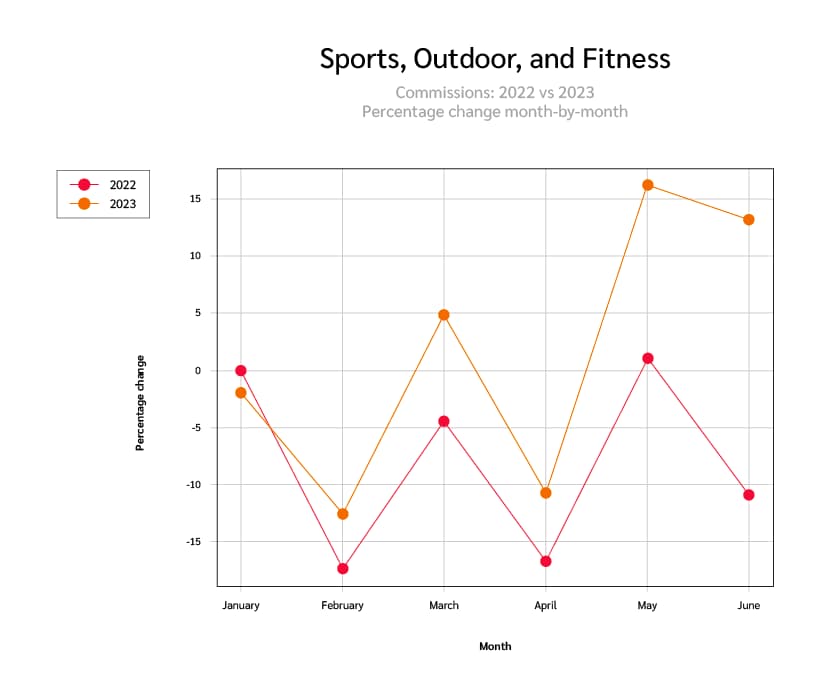

6. Sports, outdoor, and fitness brands gain momentum

Outdoor activities continue to grow following the pandemic, with 80% of activity categories revealing higher engagement last year. Shoppers seem to be stocking up on the equipment they need. While shopping habits were inconsistent at the beginning of the year, outdoor brands entered the summer strong with 7% YoY revenue growth.

Clicks jumped 21% on average YoY. While the 3% transaction growth didn’t reflect better conversion rates than the previous year, 4% higher AOV drove stronger performance for this category.

Publishers received a notable 10% more in commission payouts in the category this year compared to last, driven mainly by higher order values and increased sales.

Brave economic turbulence with the power of partnerships

Amid shaky economic conditions, partnerships offer marketers a surprising opportunity for resiliency. Performance-based partnerships allow brands to reach new customers, drive more clicks, and increase sales.

Since many partners only get paid for results, brands can offset the risk and confidently reallocate their budget to provide consistent, measurable value.

Working with partners helps brands build trust with their partners’ audiences over time, driving brand awareness while showcasing product value. Exclusive discounts offered through trusted partners can drive even more sales.

In today’s challenging economic climate, brands need an ace up their sleeve to reach discerning consumers. Doubling down on a partnership program gives brands the scale they need to reach and convert new customers with minimal risk.

Preparing for the second half of 2023

Rising inflation hasn’t stopped consumers from shopping in the first half of 2023—they’ve simply become more intentional.

In 2023, an increasing number of shoppers actively seek discounts or strategically hold off on purchases until deal days arrive. As they rely on publishers to unearth these money-saving opportunities, it’s evident that these partners will maintain their crucial position in shaping consumer shopping behaviors throughout the year

In anticipation of the 2023 holiday season, it’s essential to equip yourself with robust strategies that maximize your budget’s effectiveness. Explore how strategic partnerships can empower you to weather the storm ahead.