Hydrogen as a fuel and its role in the decarbonization of the energy sector[i]

Fossil fuel consumption coupled with rising industrial activity and transportation requirements have been responsible for greenhouse gas (GHG) linked temperature rise and climate change. In an attempt to curb temperature rise and reverse the negative impacts of climate change, governments around the world have committed to reducing fugitive emissions and achieving net zero emissions by 2050 and beyond. While there has been a strong focus on increasing the share of renewable energy in the overall energy mix, specific attention is also being paid to realizing sustainable forms of heating and transportation fuel, which constitute a major portion of global GHG emissions. This very requirement of a multi-modal sustainable fuel source is where hydrogen will have a key role to play in a future decarbonized energy mix. While the current use of hydrogen is primarily as a chemical feedstock, hydrogen as a fuel could play a differentiated role in future energy systems, finding applicability across industry, transportation, power generation and storage.

Globally, as of January 2023, more than 1,000 large-scale hydrogen projects are proposed to be developed worldwide, which is an additional 350 projects over announcements made in 2022. Of the total proposed projects, 795 projects are expected to be partially or fully commissioned by 2030, representing a total investment of USD 320 billion in direct investments into hydrogen value chains, up from USD 240 billion.[ii]

Types of Hydrogen

Hydrogen can be produced through multiple sources. Depending on the fuel source and the type of production employed, a color-based classification has been assigned to differentiate between the various types of hydrogen. [iii]

| Sr. No | Hydrogen Type | Energy Source |

| 1 | Grey | Natural gas based without carbon capture |

| 2 | Blue | Natural gas based with carbon capture |

| 3 | Green | Renewable electricity based |

| 4 | Black and Brown | Coal based |

| 5 | Pink | Nuclear power based |

| 6 | Turquoise | Methane pyrolysis based |

| 7 | White | Naturally occurring geological hydrogen |

Depending on the fuel source and the manufacturing process employed, different types of hydrogen vary in terms of their carbon emissions, the most sustainable being “green hydrogen” produced through renewable electricity.

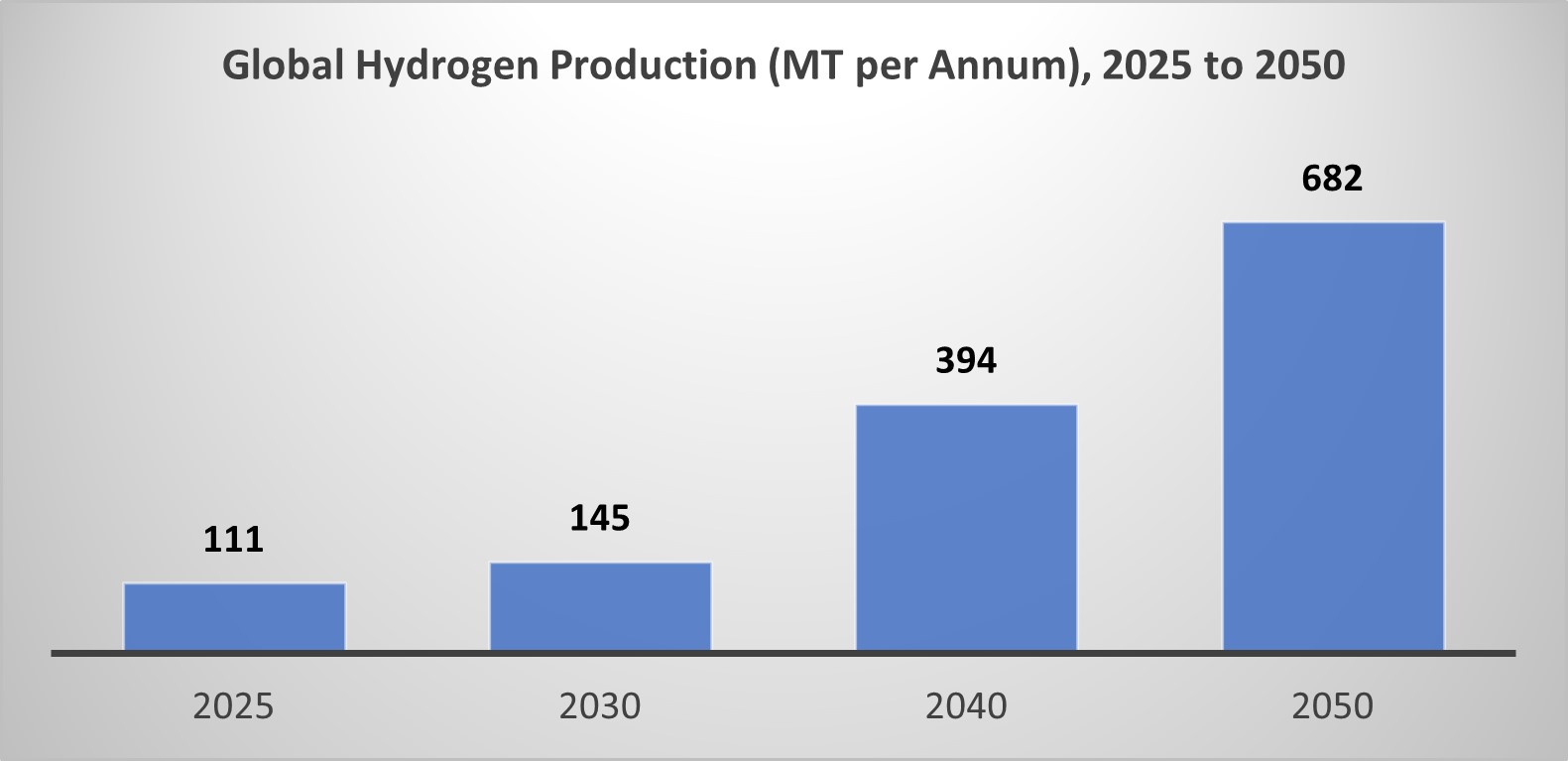

Global Hydrogen Production – Current and Forecast Estimates

As of 2021, the total global production of hydrogen was estimated at 94 million tons per annum.[iv] With a view to supporting the net zero agenda of global economies, global hydrogen production is expected to increase significantly to an estimated 682 million tons per annum by 2050.[v]

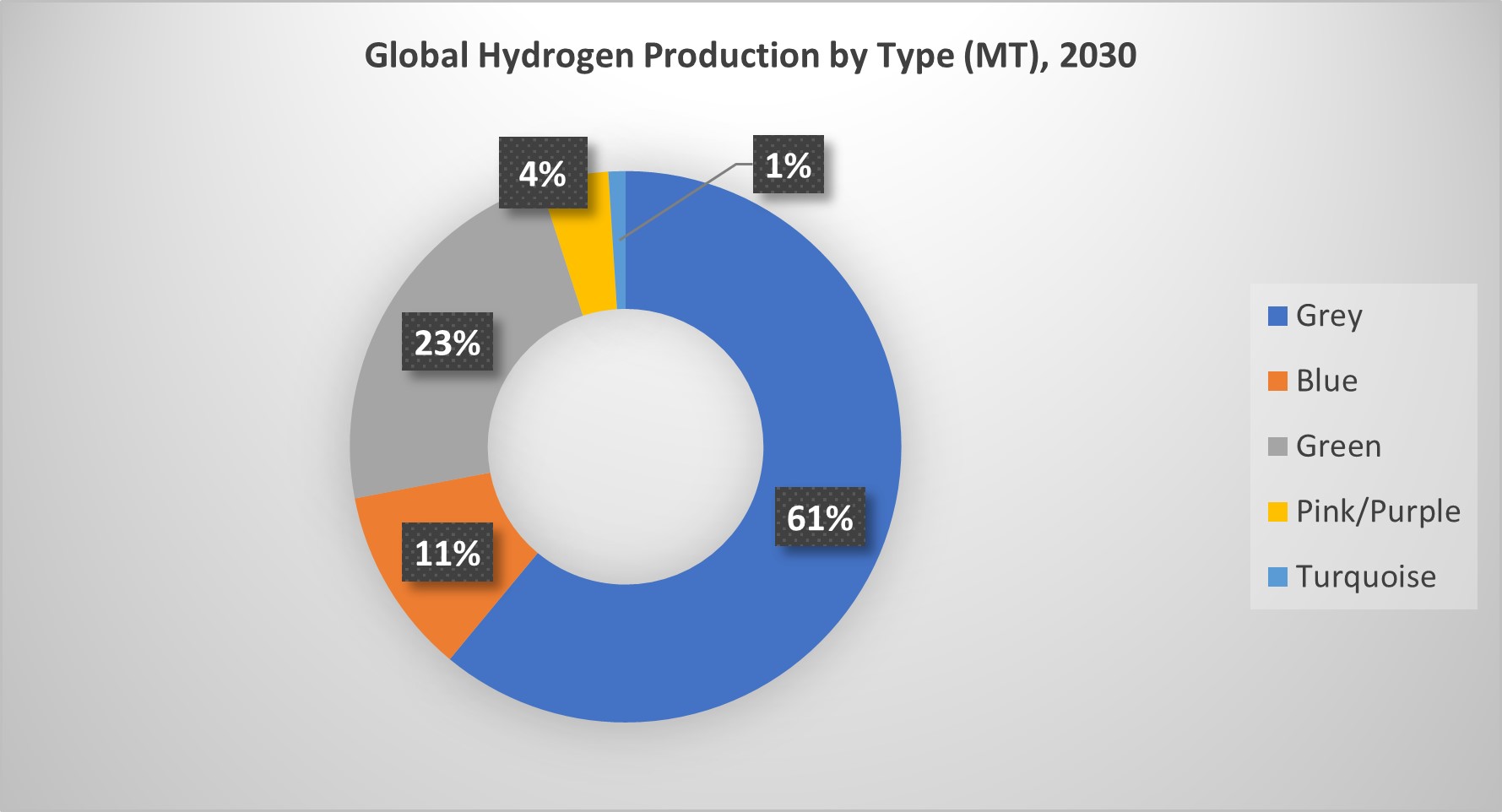

Forecast hydrogen production by type/ color, 2030 [vi]

The upcoming decade will also witness a significant increase in the share of sustainable hydrogen forms, including green and blue hydrogen. The share of sustainable forms of hydrogen in the global hydrogen mix is expected to increase from <1% in 2021 to ~34% by 2030.

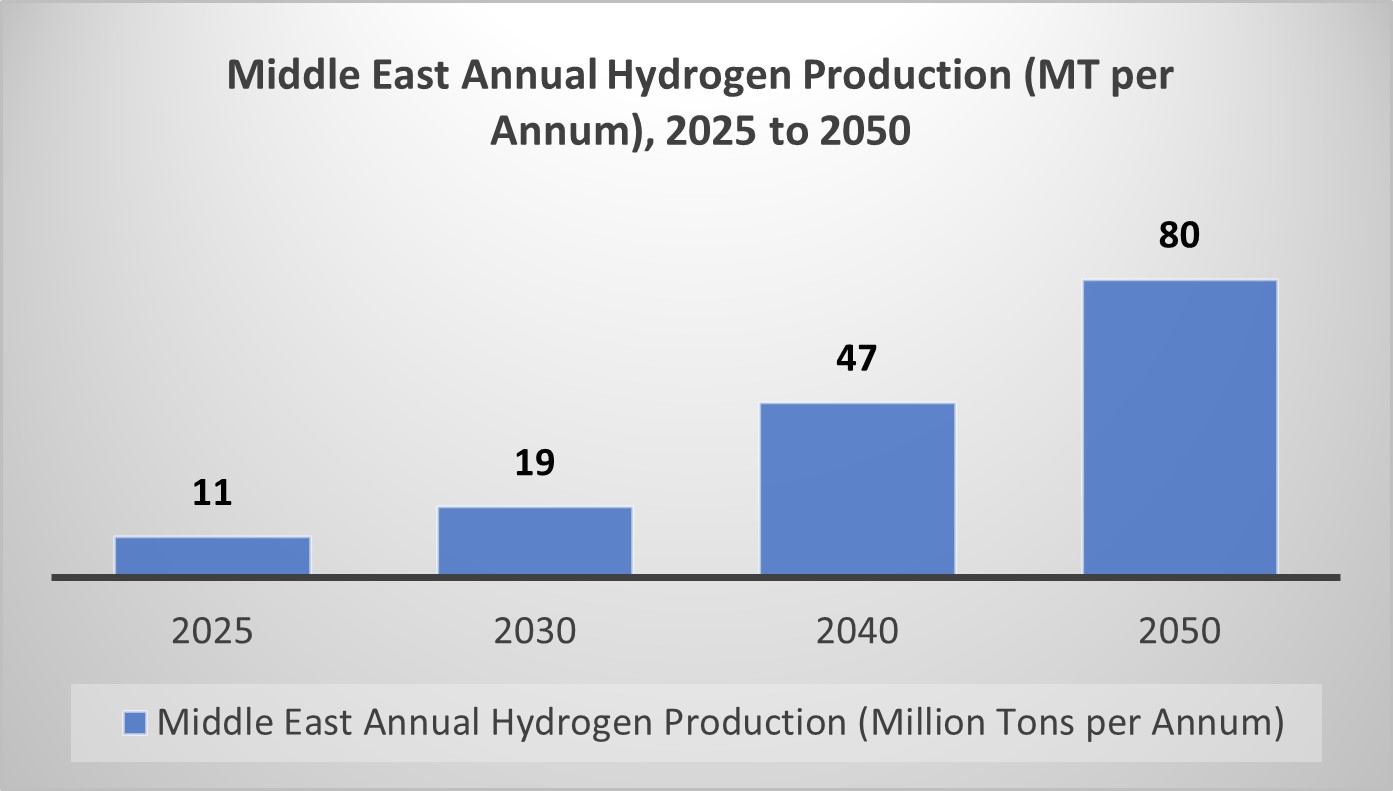

Middle East Hydrogen Production – Forecast estimates[vii],[viii]

In the Middle East, hydrogen production is expected to increase to an estimated 19 million tons per annum by 2025, further expanding to an estimated 80 million tons by 2050.[ix] Of the additional production capabilities, a significant portion of the investment is expected for the production of green and blue hydrogen, where GCC economies like the Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE) and Oman are expected to take the lead.

The GCC and wider Middle East region demonstrate strong renewable potential. Suitable sites across the region (especially along the coast) demonstrate strong complimentary solar and wind power capabilities. These aspects can be effectively leveraged by countries in the region to emerge as key players in the green hydrogen market while delivering hydrogen at globally competitive prices.

Hydrogen Production in KSA, UAE, Oman

Kingdom of Saudi Arabia (KSA)[xi]

Development of hydrogen infrastructure and production of sustainable forms of hydrogen for exports and local consumption are key focus areas under the Kingdom’s hydrogen strategy. The country envisages becoming a key exporter of blue and green hydrogen and its derivatives while achieving a leading position in hydrogen and ammonia production, distribution, transportation, and utilization.

Saudi Arabia is aiming to become the world’s leading supplier of hydrogen, with production targets of 2.9 million tons per year by 2030 and 4 million tons per year by 2035. The country is currently focused on gaining a large market share in blue hydrogen, particularly in the form of blue ammonia, in the coming decade.[xii]

United Arab Emirates (UAE)[xiii]

The United Arab Emirates (UAE) launched its updated National Hydrogen Strategy in 2023, which aims to position the country as a leading producer and exporter of low-emission hydrogen over the next eight years. The strategy will focus on developing supply chains, establishing hydrogen oases, and creating a national research and development center. UAE plans to develop at least two hydrogen production hubs called “Oasis” by 2031. The country is targeting to produce 1.4 million tons of hydrogen annually by 2031 and expects to increase production tenfold to 15 million tons by 2050.[xiv] Of the total 1.4 million tons of hydrogen that the UAE plans to produce by 2031, 1 million tons will be green hydrogen produced by Masdar, a clean energy firm in the UAE. The remaining 0.4 million tons will be blue hydrogen produced using natural gas.[xv] As of March 2023, the UAE had around 28 green and blue hydrogen projects, seven of which had reached the final investment decision.[xvi]

Sultanate of Oman

The Sultanate of Oman has strong ambitions of transitioning to a net zero economy by 2050.[xvii]

Renewable energy based hydrogen production and export will form a key part of Oman’s energy transition and will be critical in the country achieving its NDCs towards climate change. Owing to its high-quality renewable resources, convenient location, vast amounts of land, and existing fossil fuel infrastructure, Oman has the potential to be one of the most competitive producers of renewable hydrogen globally.

Oman has set ambitious targets for renewable hydrogen production, with a goal of 7.5 million tons to 8.5 million tons. The country has set targets to produce at least 1 million tons to 1.25 million tons of green hydrogen by 2030, further increasing up to 3.25 million tons to 3.75 million tons by 2040 and up to 7.5 million tons to 8.5 million tons by 2050.[xviii] As of date, Oman’s hydrogen development plans are largely centered around the export market through the production of green hydrogen derivatives such as green ammonia and green methanol. However, upcoming and proposed investments in the manufacturing of green steel and green aluminum are expected to act as key demand drivers for local consumption of green hydrogen.

Oman is actively working to realize its renewable hydrogen targets. It has established an independent entity, Hydrogen Oman (HYDROM), to lead and manage the implementation of its hydrogen strategy. HYDROM has released the result of the first auction for land allocation to renewable hydrogen projects, with six projects being awarded to consortiums comprising of global players like British Petroleum (BP), Shell, Linde, ACWA power, amongst others.

The development of green hydrogen infrastructure and production capabilities in the region will present a revenue opportunity for respective countries through the export of green hydrogen derivatives while also presenting an opportunity to increase revenues through the export of additional amounts of natural gas that could possibly be displaced through local hydrogen consumption.[xix] The limited capability of key demand regions in achieving self-sufficiency in hydrogen production and supply creates a strong opportunity for the GCC to provide cost-competitive green hydrogen and emerge as a key enabler in global decarbonization. Price and carbon emissions associated with hydrogen production are expected to be key determinants for the hydrogen supply in European and Asian markets. Under such circumstances, it would be critical for the GCC to leverage a first-mover advantage and commit investments to achieve future cost competitiveness in the wake of rising competition.

[i] https://hydrogencouncil.com/wp-content/uploads/2023/05/Hydrogen-Insights-2023.pdf

[ii] https://hydrogencouncil.com/wp-content/uploads/2023/05/Hydrogen-Insights-2023.pdf

[iii] National Grid https://www.nationalgrid.com/about-us

[iv] https://iea.blob.core.windows.net/assets/c5bc75b1-9e4d-460d-9056-6e8e626a11c4/GlobalHydrogenReview2022.pdf

[v] Global-Hydrogen-Flows.pdf (hydrogencouncil.com)

[vi] Frost & Sullivan Analysis

[vii] https://www2.deloitte.com/content/dam/Deloitte/xe/Documents/energy-resources/me_hydrogen-economy-superpower.pdf

[viii] Enablers to become the hydrogen economy superpower (deloitte.com)

[ix] https://hydrogencouncil.com/wp-content/uploads/2022/10/Global-Hydrogen-Flows.pdf

[x] https://hydrogencouncil.com/wp-content/uploads/2022/10/Global-Hydrogen-Flows.pdf

[xi] Frost & Sullivan Analysis

[xii] https://www.csis.org/analysis/saudi-arabias-hydrogen-industrial-strategy

[xiii] https://etn.news/buzz/uae-national-green-hydrogen-production-hubs-targets-strategy

[xiv] reuters.com/world/middle-east/uaes-revised-energy-strategy-includes-big-hydrogen-plans-2023-07-11/

[xv] https://www.reuters.com/world/middle-east/uaes-revised-energy-strategy-includes-big-hydrogen-plans-2023-07-11/

[xvi] https://www.hydrogeninsight.com/policy/uae-targets-15-million-tonnes-of-green-hydrogen-production-by-2050-as-it-approves-national-h2-strategy/2-1-1480383

[xvii] https://www.iea.org/news/oman-s-huge-renewable-hydrogen-potential-can-bring-multiple-benefits-in-its-journey-to-net-zero-emissions

[xviii] https://iea.blob.core.windows.net/assets/338820b9-702a-48bd-b732-b0a43cda641b/RenewableHydrogenfromOman.pdf

[xix] https://iea.blob.core.windows.net/assets/338820b9-702a-48bd-b732-b0a43cda641b/RenewableHydrogenfromOman.pdf